VCA DIGITAL CLAIMS PAYMENTS

Introducing VCA Software’s instant digital claims payments – empowering claimants to choose their preferred payment method – virtual card, bank transfer or check.

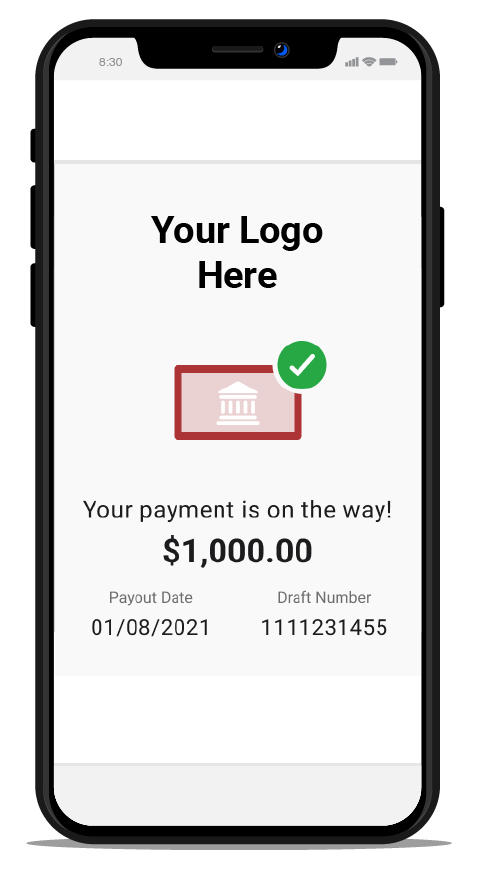

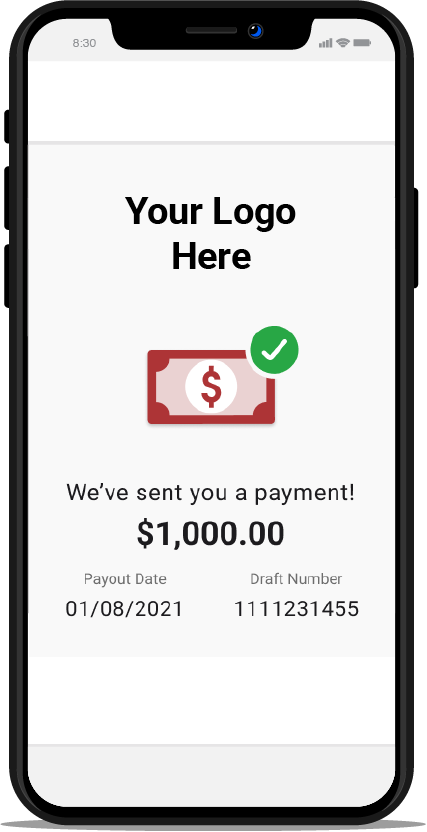

By processing payments in real time, claimants can now receive their payouts in as little as 15 seconds. Faster claims resolution results in happier policyholders and less customer churn.

Digital payments can now be turned on for VCA Software customers in North America. Customers – contact VCA Client Services to learn more. If you’re not a VCA Software customer yet, request a demo to see how the VCA platform can revolutionize your results.

Virtual Card

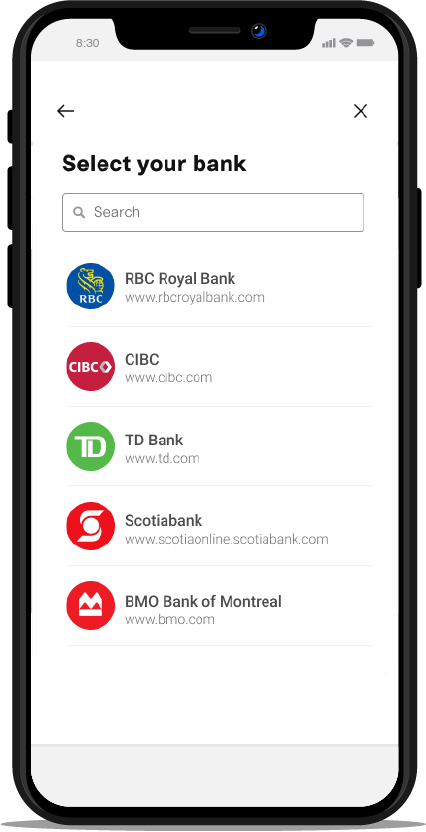

Bank Transfer

Check Payment

Increase Speed & Enhance the Customer Experience

The VCA Digital Claims Payment solution is made specifically for the insurance industry. Its modern, intuitive user experience makes funds available to payees through their preferred method, including bank transfers available to any financial institution and account. Real-time payments greatly reduce the amount of time it takes for claimants to receive funds, shaving days off your time to resolution. This improves the experience and helps you retain more customers.

- Intuitive, flexible, and convenient.

- Bank agnostic – payees can select their preferred financial institution & account.

- Transparency – payees have visibility to their payment lifecycle via an online portal.

- Reduces hassle and policyholder churn due to lost checks and slow payments.

Automate Payments and Communication

Payment processing is embedded in VCA’s claims management platform. Upon claim approval, payments are now issued automatically to recipients. Both the payee and payor receive email notifications upon acceptance and receipt of funds. Both can also check payment statuses in the VCA portal.

- Payments are issued automatically on claim approval.

- Orchestrated customer journey from payment notification through onboarding, acceptance and preference management.

- Email notifications are sent to the payee throughout the Payment Lifecycle.

Reduce Costs and Enhance Operational Efficiency

By using VCA Digital Payments, you’ll reduce expenses related to traditional checks, customer support inquiries, and manual payment processes. Plus, the claims process automation makes file handler workflows more efficient. Best of all, you can launch VCA Digital Payments immediately without a big technology investment.

- Improve file handler workflow and efficiency.

- Launch Digital Payments rapidly without a high technology spend.

- Minimizes /eliminates check-related claims costs including paper.

Increase Security and Control

Gain real-time visibility into payment flow and manage payments directly from the VCA Software platform. You can approve, cancel, or stop any claimant or supplier payment as required. Our payment processing system has bank-level security and is compliant with treasury service and banking regulations.

- Bank level security and compliant with treasury service and banking regulation.

- Native fraud detection, control and management through Identity and bank validation.

- Payment lifecycle management controls enable you to easily stop or cancel a payment.

Want to learn more?

Not a Customer yet?