What leads to policyholder dissatisfaction? There are many possible reasons a claim can go sour, from delays that make the process drag on to settlements that don’t meet the claimant’s expectations. The claim handler’s attitude is another factor – and it’s one that claim professionals sometimes overlook.

Claims Satisfaction Is Down

The J.D. Power 2022 U.S. Auto Claims Satisfaction Study shows customer satisfaction has dropped by seven points. As repairs are taking longer, the claims cycle has gone from a 12-day pre-pandemic average to an average of nearly 17 days. Claimants are growing impatient. The report says expectation management and empathy are essential.

Claim Professionals Can’t Control Everything – But They Can Control Attitude

Some things are outside of the claim handler’s control. Widespread economic trends like the microchip shortage, supply chain problems, and labor issues all impact claims process times. There’s not much that claim handlers can do about these issues.

However, this doesn’t mean claim professionals are helpless against rising claimant dissatisfaction. Although they can’t control everything, they can control the attitude they bring to the claim.

Why Attitude Matters

Like everyone, claim professionals sometimes have bad days. They may not be feeling well, they may be stressed because of a heavy workload, or they could be dealing with personal problems. Regardless of the reason, it’s reasonable they might have a bad day from time to time.

But the claimant is definitely having a bad day. The claimant is in the middle of a crisis and is counting on the claim professional to make things right.

If the person who rings up your coffee or fast food order seems rushed or doesn’t give you the attention you deserve, you might be a little annoyed – or you might just accept that the person is busy and not mind. On the other hand, if the person handling your claim doesn’t give you the attention you deserve, you’ll probably be upset. You might start to wonder whether the insurance company is going to handle your claim well. You might even worry about being cheated out of the settlement you deserve.

For many policyholders, the claim process is emotional and stressful. They need to be reassured they’re in good hands – and the claim professional’s attitude plays a big role in this.

Similar Claims, Different Experiences

Imagine that two policyholders, Sarah and Susan, both have similar auto claims involving severe storm damage. In both cases, the insurance company settles the claim in 16 days for similar settlement amounts. However, Sarah rates her experience positively and Susan rates her experience negatively.

When Sarah called her insurer to report the loss, she was able to speak to a representative almost immediately. The person she spoke to seemed caring and confident and apologized for the fact claims were taking longer than usual because of parts shortages and the large volume of claims caused by the storm. The representative promised to keep Sarah informed of any developments – and, sure enough, Sarah received regular updates. The claim handler assigned to her case explained the process clearly and specified exactly what information was needed. Sarah received answers to her questions quickly and, in light of the delays she’d been warned about, the claim payout arrived sooner than she expected.

Susan’s experience was different. She had trouble reaching a human representative and never had a clear idea of what the process would involve or how long it would take. She submitted documents only to be told there was a problem and she had to submit them again. The claim handler seemed annoyed by her questions, and, although the settlement amount was satisfactory, she didn’t understand why it took so long.

Understanding the Root of the Problem

Many claims professionals enter the industry because they want to help people. They don’t intend to adopt bad attitudes, but it can happen for a variety of reasons.

- Claim handlers deal with a high volume of claims. Over time, they may start to become jaded. It’s important to remember that claims are not an everyday occurrence for the claimant and treat each case with care and empathy.

- Some claimants may have a bad attitude. They’re stressed and may be distrustful of insurance companies. Although claim handlers shouldn’t have to tolerate abusive behavior from policyholders, a little grace may be in order.

- Claim handlers are busy. Even if they want to give each policyholder plenty of time and attention, they may be unable to. A better claims management process can free up time to allow claim handlers to focus on claimants instead of tedious tasks.

Solutions to Raise Policyholder and File Handler Morale

If your policyholder dissatisfaction levels are rising, it may be time for a new attitude – and a new claims management software. VCA’s claims management software supports automated and more efficient claims processes, fast and accurate claims resolutions, and positive policyholder experiences. By eliminating mundane tasks, the VCA claims platform saves two hours per day, per file handler, on average. You can check your own companies potential return on investment here.

If your policyholder dissatisfaction levels are rising, it may be time for a new attitude – and a new claims management software. VCA’s claims management software supports automated and more efficient claims processes, fast and accurate claims resolutions, and positive policyholder experiences. By eliminating mundane tasks, the VCA claims platform saves two hours per day, per file handler, on average. You can check your own companies potential return on investment here.

These kind of upgrades can make a big difference in file handler job satisfaction. Happier file handlers tend to create happier policyholders.

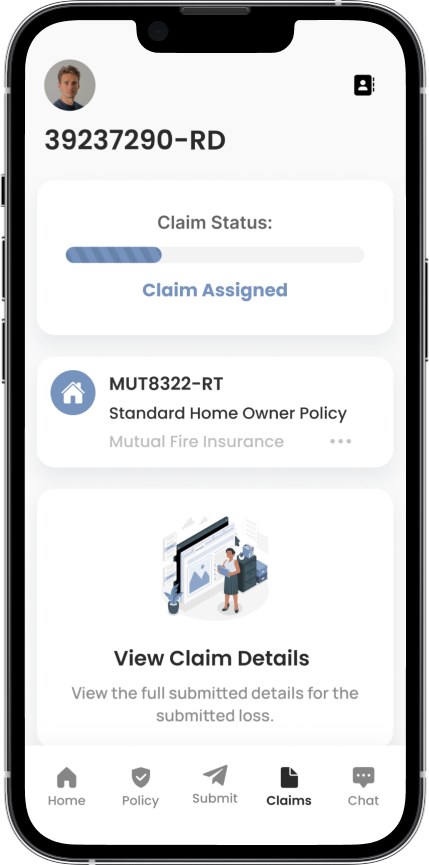

VCA Software has also introduced a policyholder app that is a gamechanger in your quest to eliminate policyholder dissatisfaction. This innovative new tool enables improved communication and sharing between file handlers and policyholders. With the app, policyholders can check their claims status from their smartphone anytime – without having to call or email file handler – which creates even more inefficiency.

Request a demo to learn more. We’d love to show you what’s possible.