The year 2020 was a landmark year for insurers.

The 2020 Atlantic hurricane season was one of the most active on record and the claims industry had to quickly pivot to adapt to the added challenges of the pandemic. Last year had 30 named storms, breaking the record of 28 set in 2005. The season also broke the record for the most storms making landfall in the U.S. with 12 hurricanes, an amount not seen since 1916.

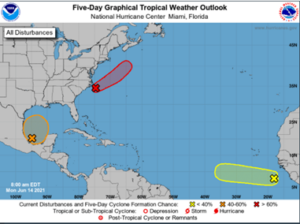

So, what of 2021? NOAA is predicting 13-20 total named storms, 6-10 hurricanes, and 3-5 major hurricanes (Category 3 or higher). All of those categories are above the average of 14 total named storms, seven hurricanes, and three major hurricanes. Hurricane researchers at Colorado State University concur with NOAA in their annual Hurricane Activity forecast, citing the likely absence of El Niño as a primary factor: “Tropical Atlantic sea surface temperatures are near their long-term averages, while subtropical Atlantic sea surface temperatures are much warmer than their long-term average values.”

A look back at 2020 offers guidance for loss adjusting and effective claims management in the 2021 season. The loss adjusting and claims industry had to quickly pivot and incorporate new tools, technologies and workflow efficiencies for processing claims and creating timely resolutions during the unprecedented COVID-19 pandemic. Faster, smarter and more effective response became a mantra in 2020 for insurers who wanted to remain agile and competitive.

In 2021, loss adjustment planning will again need to be nimble and able to respond quickly to the unpredictable and ever-changing storm environment. The use of technologies can be incorporated throughout the claims process and can greatly mitigate any contingency that could possibly arise. Using a platform which can quickly sort through claims smartly— distributing them to adjusters based on location, workload capacity and productivity scores, further enhances the automation process.

In this 2021 storm season, efficient workflows will be pivotal in helping you:

- Create standardized templates, eliminating the need to reinvent the wheel every time you send out a communication.

- Track and view files within the workflow to help prioritize workload.

- Stay organized with reminders and diary updates ensuring nothing falls through the cracks.

- Quickly capture relevant data on behalf of your customers, with real-time data and imagery collection.

Through smart devices, adjusters and users with access to VCA can facilitate timely reporting and assessment. VCA’s mobile features assist insurers by allowing them to:

- View file data

- Upload and review images and attachments

- View reminders, messages and appointments

- Enter time and disbursements

- Add file notes and update status

- Email insured and insurer

Best of all, our platform processes large numbers of claims—fast—while reducing the cost of a claims journey up to 30%.

Climate change is a reality. 2020 has taught us that leveraging technology is the best way to remain prepared for storm seasons. In a world that requires insurers to expect the unexpected, VCA has your back.