Seamless. Streamlined. Efficient.

We are talking about workflow—the managing of tasks in an insurance company from initial claim to resolution. Consisting of a sequence of connected steps, workflow is a depiction of a sequence of operations. It is the ‘flow’ of ‘work’ – generally from initial contact, through final billing.

But what do words like ‘streamlined’ and ‘seamless’ actually mean when applied to the tasks an insurer must accomplish daily, weekly, or seasonally?

Exactly how would your company benefit from having an optimized workflow?

In one word, it can save you TIME – which, in turn, translates to money.

Where there are ‘hands-on,’ time is lost. Time which could be billed.

Insurance companies have numerous processes that are traditionally operated manually. Even as we turn into the next decade, claims processing in the modern insurance space remains a manual, inefficient, error-prone operation. Claim information submitted through multiple channels such as email, phone, or other online forms is often entered by hand into the claims system – sometimes more than once. That’s where time gets wasted, and where errors can be made.

The first step to optimizing the insurance claims workflow is to eliminate as many manual processes as possible, without affecting customer service. In fact, automating mundane tasks frees up employees to focus on more productive, client-oriented activities.

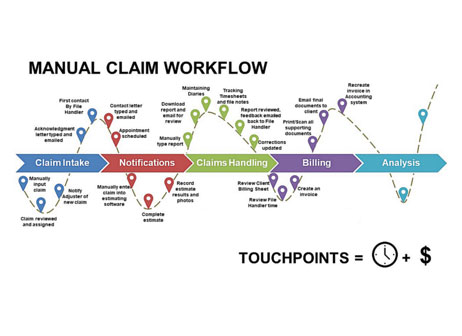

As you can see from the diagram, the entire claims process has many touchpoints, from initial claims intake, notifications, claims handling and billing. As many (or more) than 16 manual processes stand between taking in the claim and when an agency processes payment. Agencies that are successfully implementing best practices actually rewrite their workflow processes integrating technology into a new workflow system. It means a “letting go” of old ways of doing a transaction – and embracing new approaches and technologies for a more efficient process – that saves you time and money

Your workflow is broken or disconnected. Time is spent connecting parts.

Another issue that can hamper efficient claims processing is having multiple workflows—multiple apps or software that are siloed, or isolated. According to The Wall Street Journal, the average number of apps used by companies is 129. Perhaps you have an app that helps users view documents, but it is not connected to your main software, so it’s not in real time. Payment processing is another separate system. There are mobile apps for policy holders to submit information, and mobile apps for contractors – resulting in claims information that lives in many different locations and disconnected systems. And if your current claims, policy administration and billing systems have reached their practical limits, data is then siloed across disparate platforms and not easily available when you need it.

As a result, you struggle to capture a real-time, complete picture at any given moment of the claims process – your clients suffer from a lack of transparency – and your staff spends more time chasing information – and less time resolving claims.

As a result, you struggle to capture a real-time, complete picture at any given moment of the claims process – your clients suffer from a lack of transparency – and your staff spends more time chasing information – and less time resolving claims.

Automating the claims process

The speed and convenience with which claims are settled have a huge bearing on an insured’s reputation. Automated workflows help insurers keep the ball rolling between the multiple steps in the insurance sales cycle, making claims processing seamless. A comprehensive claims management system connects all parts of your system and speeds up the process.

Insurers can reduce the inefficiencies and inaccuracies of inputting data by hand, measurably decrease Loss Adjustment Expense, and keep customers satisfied by implementing a single platform claims management system.

Where integrating new technology makes sense

And how exactly can technology interact with the human side of the insurance experience of clients? It is definitely possible to automate to speed up the claims process and ensure compliance, but still provide superior customer service.

A few examples:

First, document management systems have the capability to completely automate. This includes preparation and tracking in a completely paperless environment.

Another example–insurance agents sometimes turn to process automation to automate specific tasks, such as automatically reaching out to prospective policyholders and collecting details of a claim.

Automation can be used for tasks that don’t need a live person, such as using video for property damage assessment; an app can help you figure out what needs to be fixed, and for how much.

A vision of the future of claims processing

Every insurer wants to be known as a company that puts client needs first and offers superior customer service. Your customers want to know that you are working hard to maximize coverage and eliminate risk. They want a well-trained, qualified staff available to be able to answer questions or concerns in a timely way.

A single unified platform. Dynamically build automation where you need it, without having to replace your entire claims system.

Ready to accelerate your enterprise’s claims process?

- Create workflows that leverage existing systems and provide them with agility

- Enable digital management of processes

- Add visibility into transactions and processes

- Reduce your dependance on paper and spreadsheets to eliminate cost, waste and errors

- Increase productivity by automating manual tasks

Seamless. Streamlined. Efficient.