Choosing the right enterprise insurance software is crucial for managing policies, processing claims, and staying compliant with regulations.

This article presents a carefully curated list of the top enterprise insurance software solutions. Our goal is to help you identify the software that best meets your needs, ensuring your business runs efficiently and effectively.

Editor’s Note: We have researched and analyzed the best enterprise insurance software using four critical criteria: Regulatory and Compliance Automation, Claims Management, Core Functionality, and Customer Reviews. Each software solution was evaluated with precision to provide a balanced and comprehensive comparison. Our commitment to objective analysis ensures that this article delivers trustworthy insights, helping you make informed choices to enhance your insurance operations. Read the full methodology here.

3 Best Enterprise Insurance Software

Here’s our list of best enterprise insurance software that have been analyzed:

#1 – VCA

Regulatory and Compliance Automation: VCA Software excels in regulatory compliance by offering features meeting industry standards. The platform supports seamless compliance reporting and integrates effortlessly with Lloyd’s mandated reports, ensuring that all regulatory requirements are met efficiently. The software’s built-in compliance tools help users maintain adherence to regional and industry-specific regulations, reducing the risk of non-compliance penalties.

Core Functionality: VCA Software provides features that address the core needs of enterprise insurance companies. From document management to time and expense tracking. Its customizable file layouts, fields, and workflows make it adaptable to a wide range of business needs, while its scalability ensures it can grow alongside your organization. The software also supports extensive integration with other essential tools like QuickBooks, CoreLogic, and digital payment systems, which enhances its overall functionality.

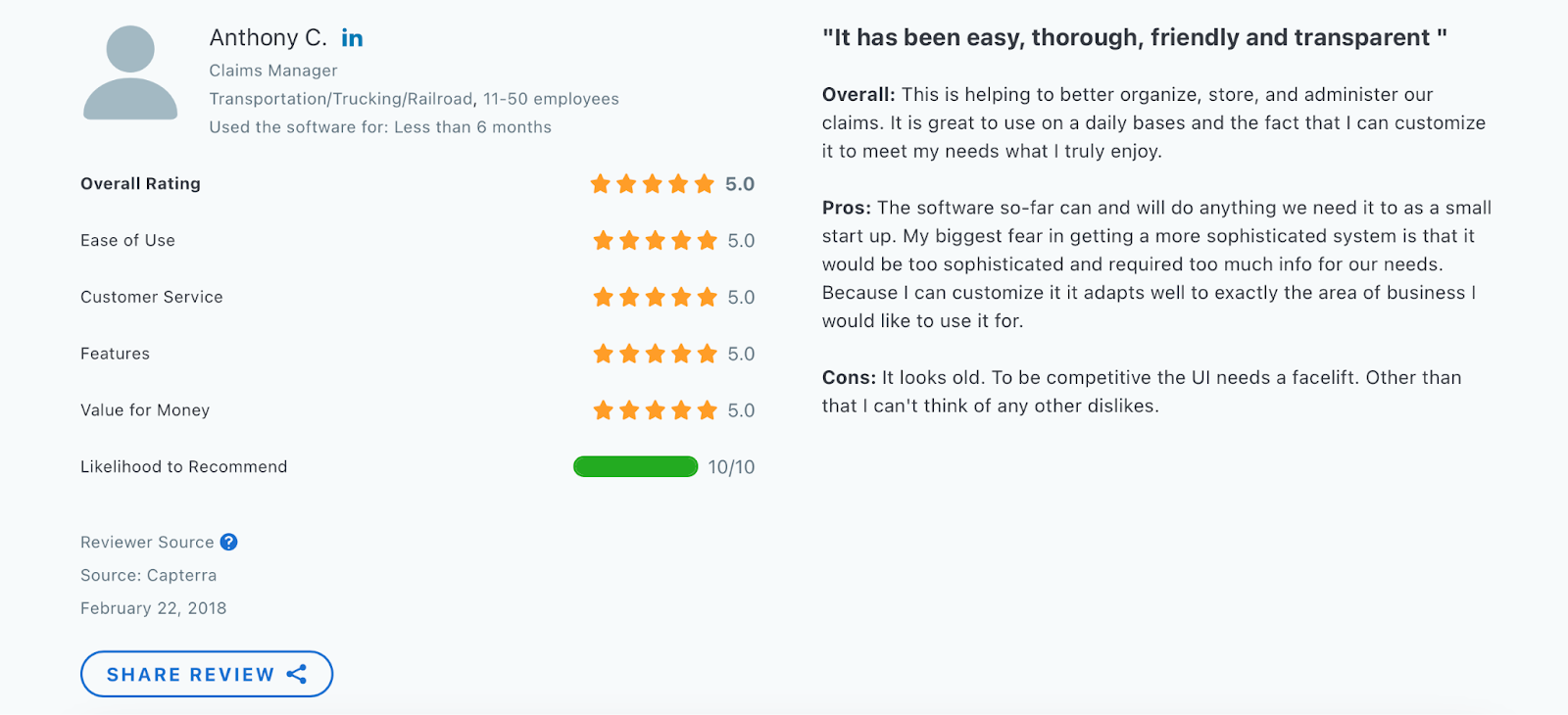

Reviews: 4.9 on Capterra

#2 – Guidewire

Regulatory and Compliance Automation: Guidewire includes features that automate compliance reporting and ensure adherence to industry regulations. For example, Guidewire’s InsuranceSuite integrates seamlessly with regulatory requirements, offering tools to manage compliance effectively across policy, billing, and claims processes.

Claims Management: Guidewire excels in claims management, offering a suite of tools that streamline the entire claims lifecycle. Their ClaimCenter solution, part of the InsuranceSuite, provides advanced analytics to improve claims processing efficiency and accuracy. The platform also includes real-time data insights and automated workflows that help insurers quickly identify severe claims and optimize adjuster workloads.

Core Functionality: Guidewire’s core products—PolicyCenter, BillingCenter, and ClaimCenter—form a comprehensive suite that supports the entire insurance process, from underwriting to claims management. These products are built on a flexible cloud platform, allowing for easy integration and scalability.

Reviews: 4.6 on Gartner

#3 – Riskonnect

Regulatory and Compliance Automation: Riskonnect’s claims administration software offers robust tools to ensure compliance with industry regulations. The platform provides automated regulatory reporting and supports compliance with state-specific requirements like First Report of Injury (FROI) and Subsequent Report of Injury (SROI). By proactively monitoring potential regulations and managing relationships with external entities, Riskonnect helps organizations stay ahead of compliance challenges.

Core Functionality: Riskonnect’s claims administration software integrates seamlessly with other systems, enabling organizations to track all claim details in one place. The software supports comprehensive document management, reserve management, and workflow automation, which helps in eliminating duplicate work and improving data accuracy.

Claims Management: Riskonnect excels in streamlining the entire claims process, from intake to final settlement. The software offers advanced automation features that reduce manual tasks, allowing claims to move through the system with maximum efficiency.

Reviews: 4.1 on Gartner

Bottom Line

Selecting the right claims administration software is critical for optimizing your insurance operations, ensuring compliance, and enhancing customer satisfaction. Each platform—VCA Software, Guidewire, and Riskonnect—offers robust features tailored to different needs within the insurance industry.

The best choice depends on your specific business requirements, but any of these platforms can significantly improve your claims management process.

Our Scoring System Explained

Our 7-part evaluation approach ensures that each enterprise insurance software is thoroughly and fairly assessed. We developed this methodology after analyzing various software options and recognizing the importance of a comparison method based on key criteria relevant to the insurance industry.

Each provider is evaluated using four main criteria: Regulatory and Compliance Automation, Claims Management, Core Functionality, and Customer Reviews. These factors are carefully weighted and aggregated to generate an overall score, giving you a clear picture of how each software solution stands up to industry demands.

How We Score Providers

Each factor in our enterprise insurance software reviews is scored on a 10-point scale, ranging from 0 to 10. A score of 0 is assigned only if a provider completely lacks an essential feature, though this is rare if any relevant functionality is present.

Here’s how the 0-10 scale applies to enterprise insurance software:

- 9.0 – 10: Outstanding in its category (excellent)

- 7.5 – 8.9: Very good, with minor issues (very good)

- 6.0 – 7.4: Adequate performance with notable limitations (average)

- 3.0 – 5.9: Falls short of expectations (below average)

- 1.0 – 2.9: Significantly hinders overall service (poor)

- 0: Completely lacking this important feature (unacceptable)

How We Calculate Overall Scores

The four key factors reviewed are weighted to reflect their importance, with an overall total of 100%:

- Regulatory and Compliance Automation: 30%

- Claims Management: 30%

- Core Functionality: 25%

- Customer Reviews: 15%

Methodology for Each Factor

To ensure a thorough and accurate evaluation, each software is assessed on the following criteria:

Regulatory and Compliance Automation

In the highly regulated insurance industry, compliance is critical. We assess how well the software supports adherence to various regulations, including those specific to different regions and types of insurance. This includes automated compliance updates, comprehensive audit trails, and streamlined regulatory reporting.

Claims Management

Efficient claims management is a cornerstone of any insurance operation. We evaluate the software’s ability to streamline the claims process from start to finish, including automation of claims adjudication, fraud detection capabilities, and support for complex, multi-line claims. The goal is to identify solutions that reduce manual intervention and enhance the speed and accuracy of claims processing.

Core Functionality

This criterion covers the essential features required for day-to-day insurance operations, including policy management, underwriting, billing, and invoicing. We look at the flexibility of product configuration, the ease of policy adjustments, and the overall usability of the software in handling the core tasks that insurance companies rely on.

Customer Reviews

Real-world feedback from users provides invaluable insights into the software’s performance and reliability. We aggregate customer reviews from trusted platforms, considering ratings, testimonials, and any reported issues. This helps us gauge the user satisfaction and long-term reliability of the software.

|

Ilda Cairns plays an important role at VCA Claims Software, bringing over 16 years of experience to the team. She is instrumental in leading VCA implementations, ensuring smooth and efficient transitions for our clients. Ilda oversees the day-to-day support operations, consistently delivering exceptional service and solutions. Her deep understanding of customer needs and challenges makes her an invaluable advocate, serving as the voice of the customer in VCA product development. Ilda’s dedication and expertise drive the success and innovation of VCA, making her an essential part of our team. |