In the ever-evolving landscape of P&C insurance, selecting the right software can be the key to operational efficiency and competitive advantage. In this article, you can expect a comprehensive review of the top P&C insurance software solutions, each chosen through meticulous evaluation by industry experts.

We’ll dive into the core features, giving you a clear understanding of how these solutions can meet your specific needs.

Editor’s Note: We thoroughly researched and evaluated the leading P&C insurance software based on five essential criteria: Core Functionality, Integration Capabilities, Regulatory Compliance, Data Security, and Customer Reviews. Each category was carefully assessed to ensure a balanced and thorough comparison. Our dedication to objective analysis ensures that this article offers reliable and well-researched insights, empowering you to make informed decisions for optimizing your insurance operations. Read the full methodology here.

5 Best P&C Insurance Softwares

Choosing the right P&C insurance software is crucial for simplifying operations, ensuring compliance, and safeguarding data. We’ve handpicked and evaluated the top solutions on the market to help you find the best fit for your business needs.

#1 – VCA

Core Functionality: VCA Software offers tools designed to optimize claims management, including customizable workflows, automated processes, and claims tracking. It handles the whole claims management process. These features help optimize operations and reduce processing times, making it a strong performer in core functionality.

Regulatory Compliance: VCA Software emphasizes compliance with industry regulations, providing features that help insurers stay aligned with legal requirements. This includes reporting tools and compliance checks that are essential for avoiding regulatory pitfalls.

Integrations and Partnerships: VCA offers a wide range of integrations, including

QuickBooks, CoreLogic, XactAnalysis, HOVER, email and outbound digital claims

payments. VCA is also one of the few platforms that supports Lloyd’s of London

requirements.

Reviews: 4.9 on Capterra

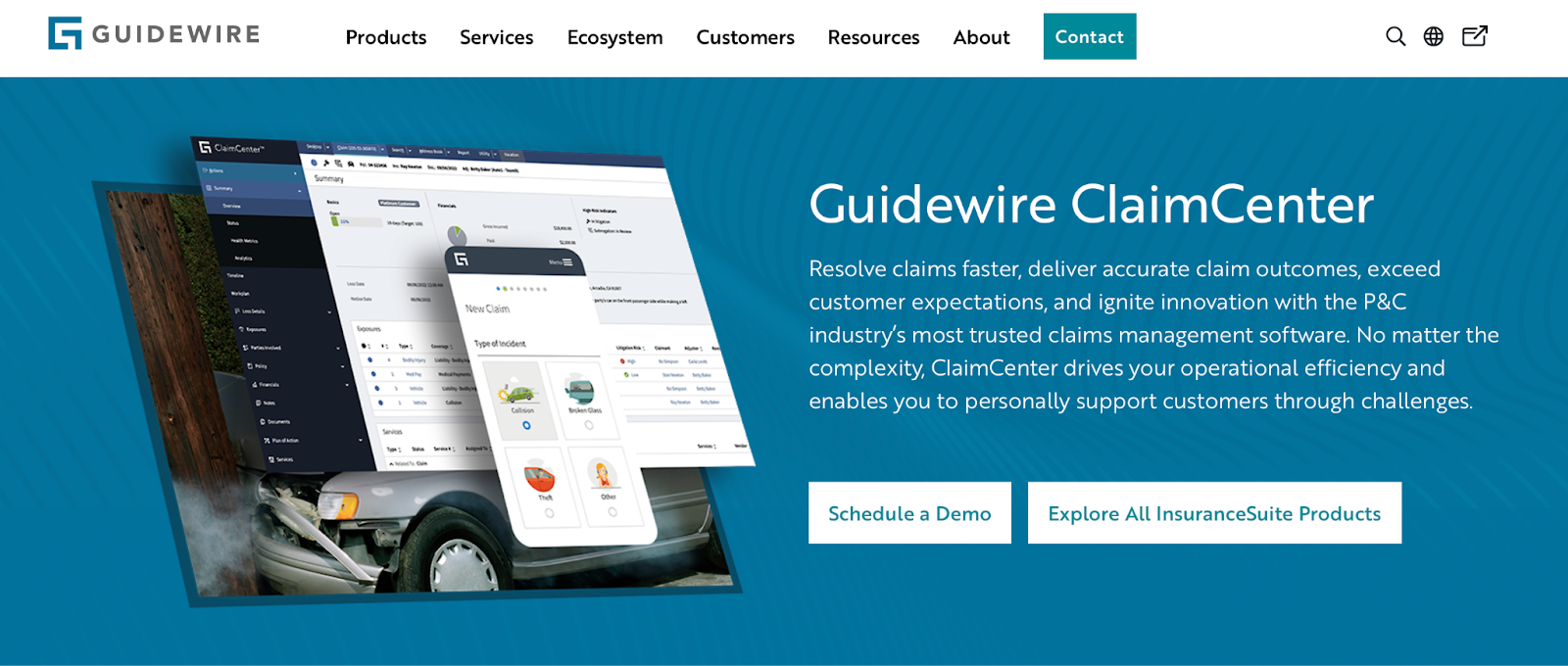

#2 – Guidewire

Core Functionality: Its core functionality includes policy administration, billing, and claims management, making it an all-in-one solution for insurers. Their flagship product, Guidewire InsuranceSuite, includes core systems such as PolicyCenter, BillingCenter, and ClaimCenter, all of which can be deployed via Guidewire Cloud for enhanced scalability and security.

Regulatory Compliance: The software is built with strict adherence to regulatory compliance, ensuring that insurers meet industry standards and regulations across various regions.

Integrations capabilities: Guidewire offers more than 60 prebuilt apps.

Guidewire is also part of the PartnerConnect ecosystem.

Reviews: 4.6 on Gartner

#3 Applied Epic

Core Functionality: Applied Epic’s core functionality includes robust tools for managing client policies, handling renewals, and processing claims. The system allows agencies to track client interactions, manage commissions, and oversee the entire policy lifecycle from a single, integrated platform.

Integration Capabilities: Applied Epic offers connectivity with a variety of third-party applications and insurance carrier systems. Agencies can easily integrate Applied Epic with CRM systems, marketing tools, and comparative raters, allowing for real-time quoting and efficient underwriting.

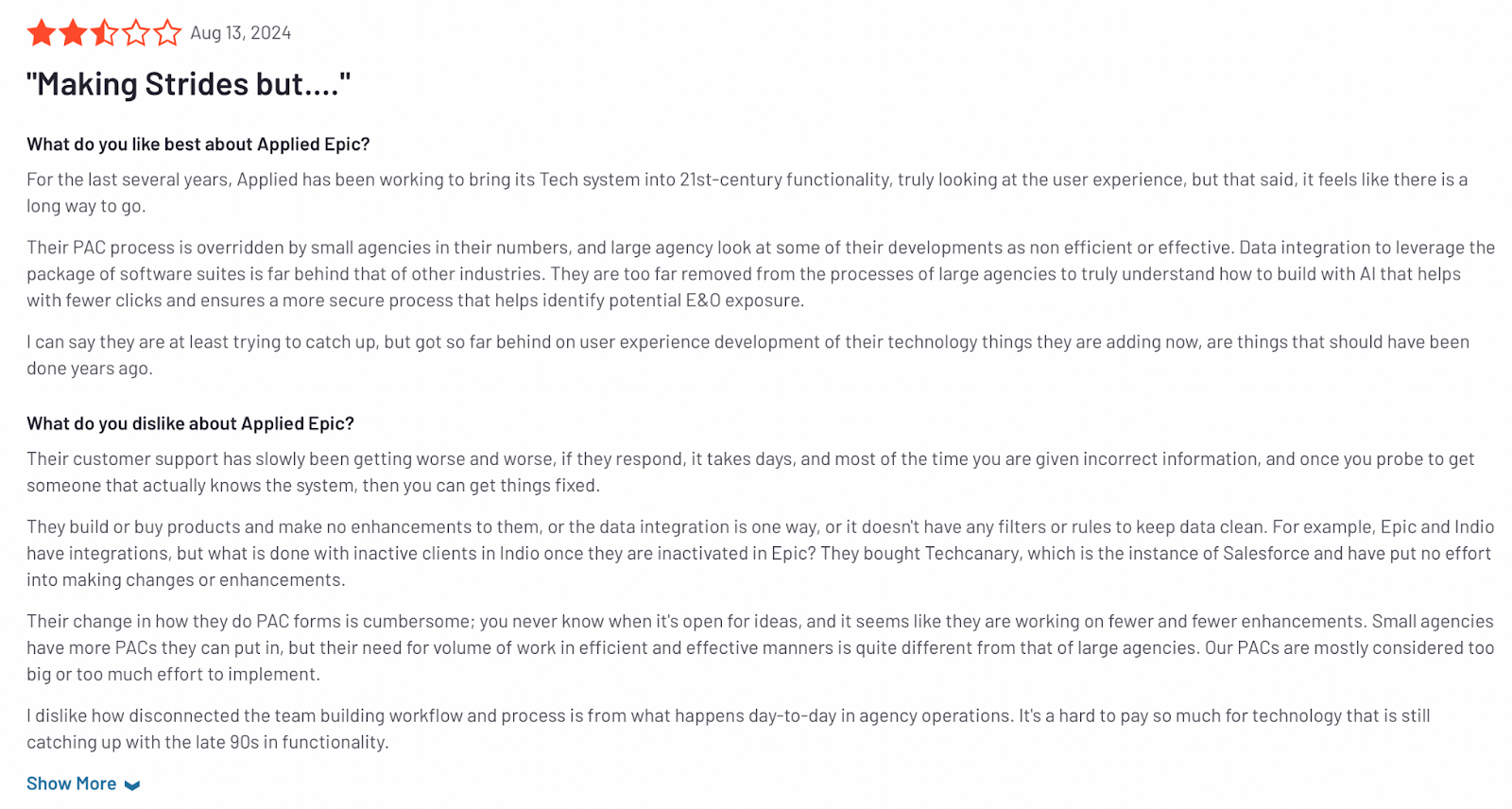

Reviews: 4.4 on G2

#4 Damco P&C Insurance Software

Core Functionality: Damco’s P&C Insurance Software covers the full spectrum of P&C insurance operations. It includes modules for policy administration, claims management, underwriting, and billing, all integrated into a single platform. The policy administration module allows insurers to efficiently manage the entire policy lifecycle, from issuance to renewal. The claims management module is equipped with tools that help expedite the claims process, reducing the time it takes to process and settle claims.

Integration Capabilities: Damco’s software is built with integration flexibility in mind. It supports seamless integration with third-party applications, legacy systems, and modern technology platforms. This ensures that insurers can enhance their existing systems without disrupting ongoing operations. Damco’s open API architecture allows for easy integration with CRM systems, data analytics tools, and other insurance-related software, enabling insurers to leverage their full technology stack.

Data Security: Data security is a top priority for Damco, especially given the sensitive nature of the information handled by P&C insurers. The software incorporates advanced security measures, including encryption, multi-factor authentication, and access controls, to protect against unauthorized access and data breaches. Damco’s software is also compliant with international data protection regulations, such as GDPR, ensuring that insurers can safely handle customer data.

#5 Indio

Core Functionality: The platform provides a user-friendly interface where clients can easily fill out insurance forms digitally, reducing the time and effort required compared to traditional paper-based methods. Indio also allows for the secure collection, storage, and management of client information, ensuring that all necessary data is readily accessible during the underwriting process.

Integration Capabilities: Indio offers integration with popular agency management systems (AMS), customer relationship management (CRM) tools, and other essential business applications.

Regulatory Compliance: The platform is built to help insurance agencies comply with industry regulations, including those related to data privacy and electronic signatures. Indio ensures that all client data is stored and transmitted securely, meeting the requirements of regulations such as GDPR and CCPA.

Reviews: 4.3 on Capterra

Bottom Line

In conclusion, selecting the best P&C insurance software requires a careful evaluation of core functionality, integration capabilities, regulatory compliance, data security, and customer reviews. Guidewire, Applied Epic, Damco, and Indio each offer unique strengths that cater to the diverse needs of insurance providers. By aligning your choice with your agency’s specific requirements, you can enhance operational efficiency, ensure compliance, and provide exceptional service to your clients, ultimately positioning your agency for long-term success in a competitive market.

Our Scoring System Explained

Our thorough approach evaluates P&C insurance software using five essential criteria to ensure that you receive the most accurate and unbiased recommendations. Following significant research and analysis, we created this technique to give a consistent and transparent way for comparing different software solutions based on key criteria.

How We Score Providers

Each P&C insurance software is rated on a 10-point scale for the following key criteria:

- Core Functionality

- Integration Capabilities

- Regulatory Compliance

- Data Security

- Customer Reviews

Scores are determined based on how well the software meets the specific needs of P&C insurers in each area. Here’s how the scale works:

- 9.0 – 10: Outstanding performance, exceeding expectations.

- 7.5 – 8.9: Very good, with minor areas for improvement.

- 6.0 – 7.4: Satisfactory, but with noticeable limitations.

- 3.0 – 5.9: Below average, missing key features or lacking effectiveness.

- 1.0 – 2.9: Poor performance, significantly detracts from usability.

- 0: Completely lacking critical functionality.

How We Calculate Overall Scores

The overall score for each software is a weighted average of the five criteria:

- Core Functionality: 40%

- Integration Capabilities: 20%

- Regulatory Compliance: 15%

- Data Security: 15%

- Customer Reviews: 10%

Methodology for Each Factor

Core Functionality

We examine the software’s ability to handle essential insurance operations, including policy administration, claims management, underwriting, and billing. A higher score reflects comprehensive features that streamline these processes and enhance efficiency.

Integration Capabilities

Effective software must seamlessly integrate with other systems and platforms, such as CRM, ERP, and third-party applications. We assess the ease and flexibility of integrations, with higher scores given to software that offers robust API support and a wide range of compatible integrations.

Regulatory Compliance

Ensuring that the software meets industry-specific regulations and standards is crucial. We evaluate the tools and features that help companies stay compliant, with extra weight given to software that provides automated compliance checks and audit trails.

Data Security

In an era of increasing cyber threats, robust security measures are non-negotiable. We score software based on its ability to protect sensitive data, including encryption, authentication protocols, and compliance with security standards like ISO 27001.

Customer Reviews

User feedback provides invaluable insights into the software’s real-world performance. We aggregate and analyze customer reviews, looking for trends in user satisfaction, ease of use, and support quality. Higher scores are awarded to software that consistently receives positive feedback.

This scoring system ensures that our evaluations are comprehensive, transparent, and aligned with the needs of P&C insurance professionals.

|

Ilda Cairns plays an important role at VCA Claims Software, bringing over 16 years of experience to the team. She is instrumental in leading VCA implementations, ensuring smooth and efficient transitions for our clients. Ilda oversees the day-to-day support operations, consistently delivering exceptional service and solutions. Her deep understanding of customer needs and challenges makes her an invaluable advocate, serving as the voice of the customer in VCA product development. Ilda’s dedication and expertise drive the success and innovation of VCA, making her an essential part of our team. |